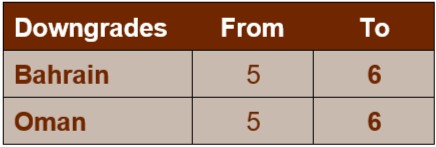

OECD premium categories: Bahrain and Oman downgraded

In accordance with the country risk classifications of the OECD Arrangement, Credendo has downgraded the premium category for political risks on medium- to long-term export transactions for Bahrain (from 5 to 6 on a scale from 1 to 7 where 7 represents the highest risk and premium category) and Oman (from 5 to 6).

The acceptance policy remains unchanged.

Overview of changes in premium categories